Paying Invoices by Credit Card

There are two main ways of handling credit card transactions. Some companies key each receipt into AP and some companies prefer to put a spreadsheet together once a month of all the receipts and key one single entry into AP. The spreadsheet is a lot easier so I will describe putting every receipt through AP. If you have multiple credit cards, we recommend multiple liability accounts to track what is owed to each credit card company.

In a simple summary, each receipt will be keyed into AP as a quick pay affecting the necessary expense accounts and accumulating all the transactions into the liability account. This will record a receipt from Office Depot as paid and accumulate an amount owing in the liability account. Later on, when the credit card bill is paid, we do not affect the expense accounts; we offset the liability account, thus bringing it back down to the total of all transactions put on the credit card that did not appear on the statement and are still owed.

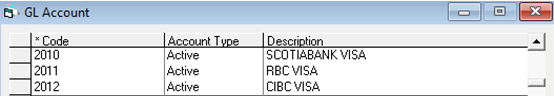

GL Master Maintenance

We have three GL liability accounts setup; one for each credit card the company has.

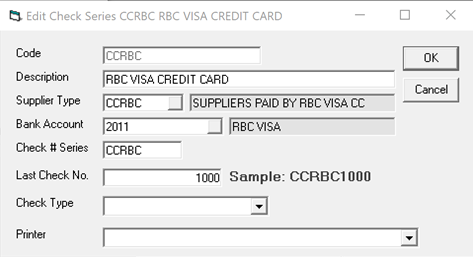

Check Series

I would also recommend you setup three check series; one for each credit card. They will all be setup the same but each check series will go to the specific liability account that credit card belong to.

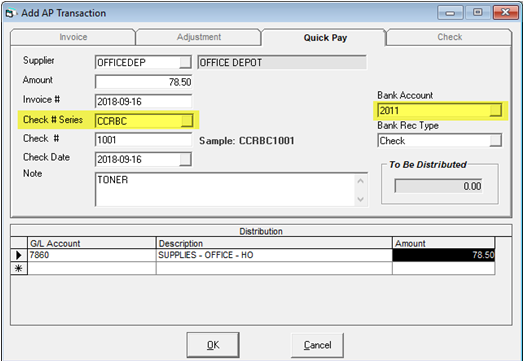

AP Transaction

You always want to use a quick pay for credit card transactions. It would be a lot more work to key each receipt in as an invoice and then do a check run.

In this example, since I have three credit cards and we do not know which one will be used each time we go to Office Depot. We would not setup the supplier as ‘CCRBC’ but would leave the supplier as Supplier Type “CC” which will then be overridden each time I do a transaction. I could leave the supplier type blank in Supplier Maintenance if I preferred.

The effect of this quick pay will be to record the invoice from Office Depot and expense it to the correct office expense GL accounts and accumulate the liability in GL 2011.

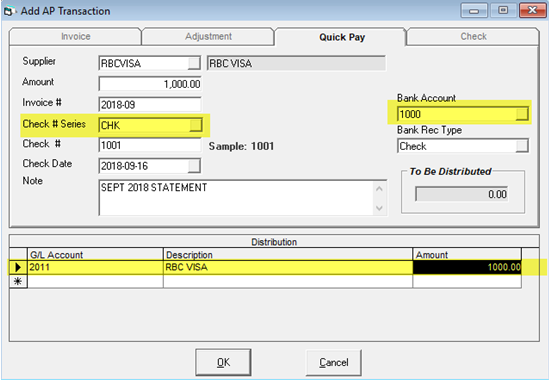

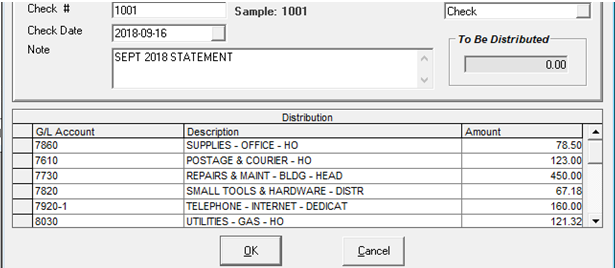

Later on, when we pay the RBC Visa, the quick pay to them will look like this:

The check series would either be ‘CHK’ or ‘EFT’ depending on how we are paying the Visa statement. Selecting the correct check series will also fill in the correct bank account.

In the distribution, the money is no longer going to office supplies; it now offsets (lowers) the liability account the original quick pay to Office Depot and all the other suppliers increased.

If you were doing a spreadsheet of all the expenses instead of keying in each receipt into AP, the original quick pay for Office Depot would not be done; it would all be replaced with one single quick pay to RBC Visa distributing the expenses for all receipts.