Supplier Sending a Check for a Credit Memo

In some situations, a supplier will decide to send you a check in place of some credit memos you have with them. In this case, when you receive the check, you need to show it as part of today’s bank deposit plus offset the credit memos in AP.

This procedure is only used when there is no amount outstanding in AR. If a supplier sends you a check or credit memo to offset an amount in AR please do the following:

There are four steps in processing the check:

-

AR Transaction Processing/Add Journal Entry

-

AR Posting

-

AP Transaction Processing/Add Adjustment

-

AP Posting

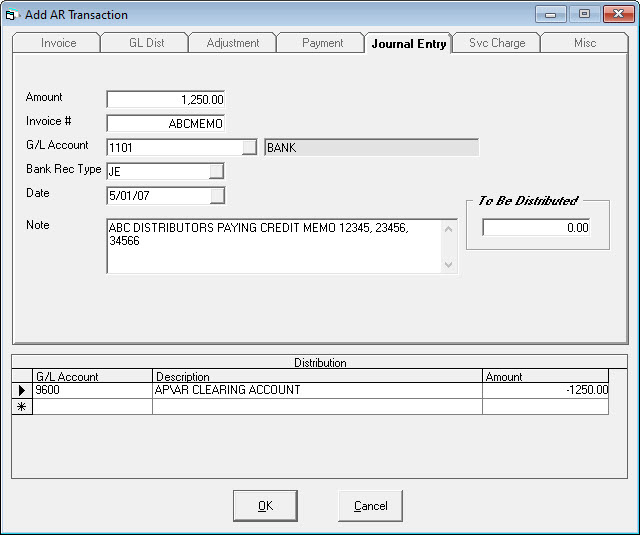

AR Transaction Processing/Add/Journal Entry

AR > Transaction Processing > Add > Journal Entry

This entry will debit (increase) the bank account and will credit the AR/AP Clearing account. The clearing account will also be used in the accounts payable side of this transaction and so the clearing account will always be zero when both sides of the transaction are completed. You always want to use a clearing account for these types of transactions, so any mistakes will stand out easily. Since clearing accounts are only used as in/out type transactions, they should always have a zero balance. If the balance of a clearing account is not zero at month end, it is pretty easy to see the activity on that account and figure out what was forgotten. If you used a regular or active account for these types of entries, it would be very difficult to find errors.

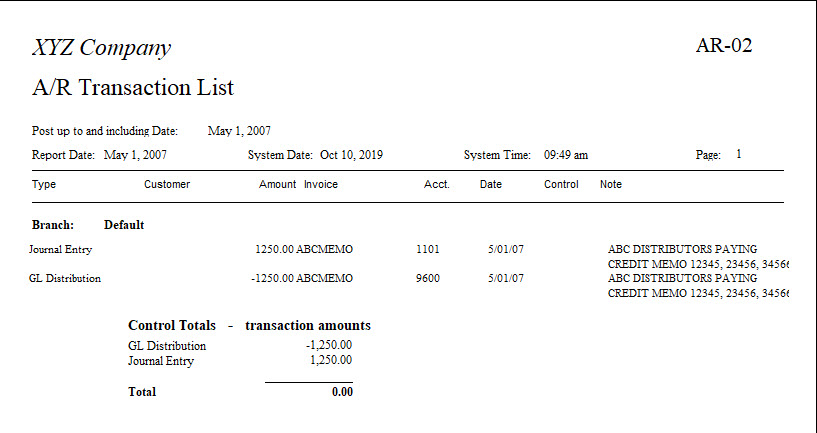

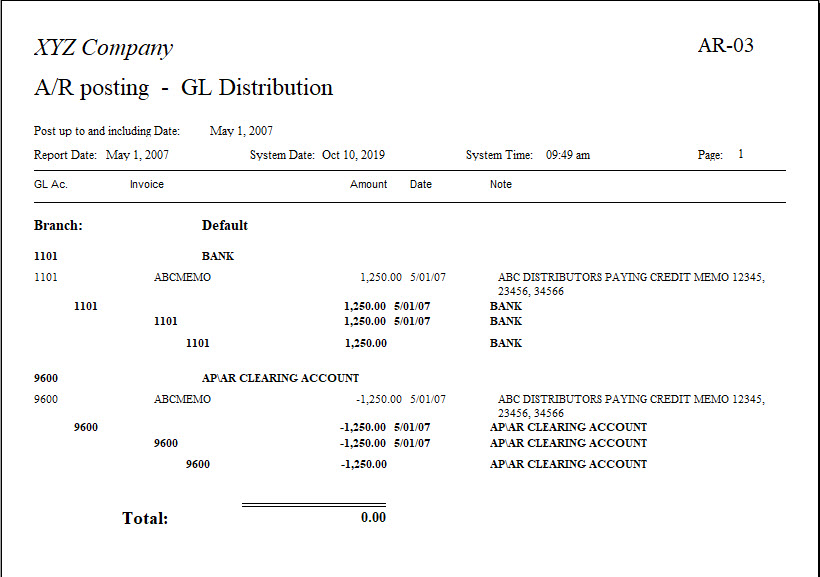

AR Posting

AR > Post Transactions

As you can see on the AR-03 - GL Distribution report, the adjustment we entered is going to the bank.

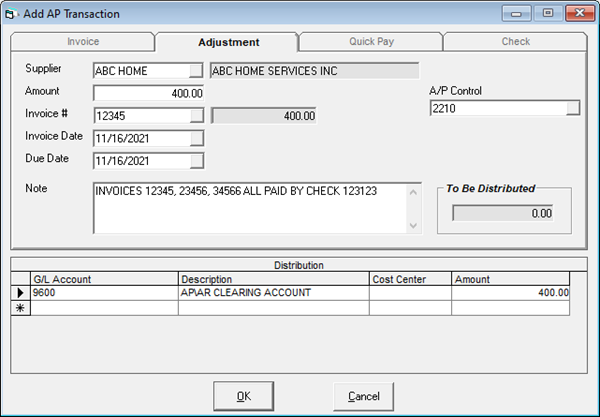

AP Transaction Processing – Add Adjustment

AP Menu > Transaction Processing > Add > Adjustment

For each of the three invoices the check is paying we need to key in an adjustment. In each case the adjustment is going to the AR/AP Clearing account and the amount needs to be the exact opposite of the balance shown to the right of the invoice number.

The AP Transaction does not change no matter what the reason the credit is being issued for. The only thing that could change is the credit may cover many invoices and keying in 50 or 100 adjustments could be tiresome. In that event you could do the same transaction as a check, but change the bank account to be the clearing account. The note becomes very important in this case, because history will show a check and without a proper explanation it could cause confusion.

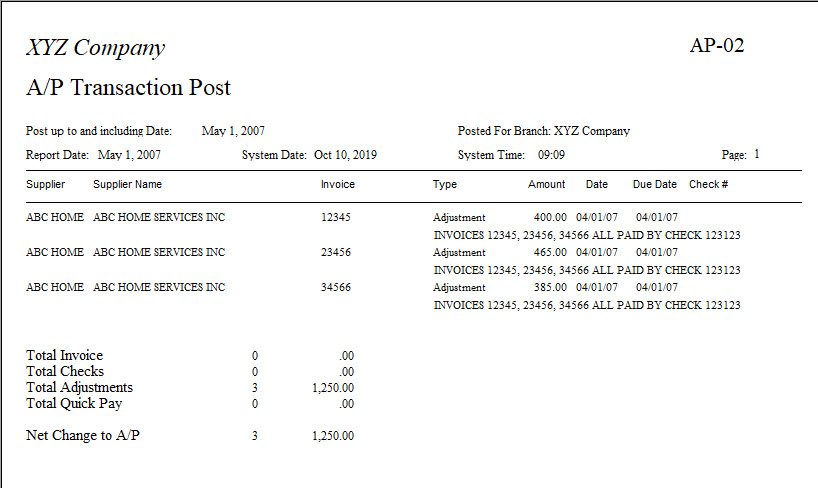

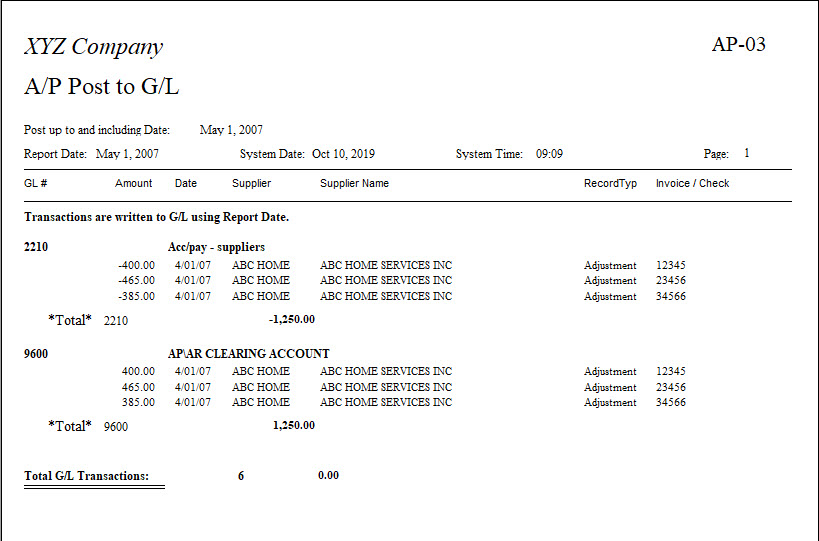

AP Posting

AP Menu > Post Transactions

All three adjusting entries have been keyed in, and notice the total on GL account 9600 AR/AP Clearing is the exact opposite amount as we posted in AR. The two postings zero each other out, and that is exactly what we expect to see when using a clearing account. If we had chosen to do these entries as a check, the only difference we would see (assuming the instructions were followed correctly) is the Type on the AP-02 report would show check. The AP-03 report would show the same GL activity. Your entries are now complete.

December 30, 2021