Supplier Discounts

Discounts can be used for multiple purposes. Discounts only relate to serial inventory. Some buying groups offer trailing or end of month discounts; sometimes you will receive truckload discounts, instant rebates, volume rebates etc. All of these should be tracked to give you a true picture of your gross margin. Discounts can also be used to track expenses such as exchange or duties. Without recognizing these discounts up front, you will not be able to keep track of what the original cost of this serial number was before any adjustments and you will never know your true gross margin, nor will you be able to track if the discounts have been received or not.

Tracking the original cost of the piece before discounts is very important if the product needs to be returned or you are comparing the current quoted cost by a supplier to what you paid last time. You also need this so the purchasing can default the correct quoted cost on your next PO.

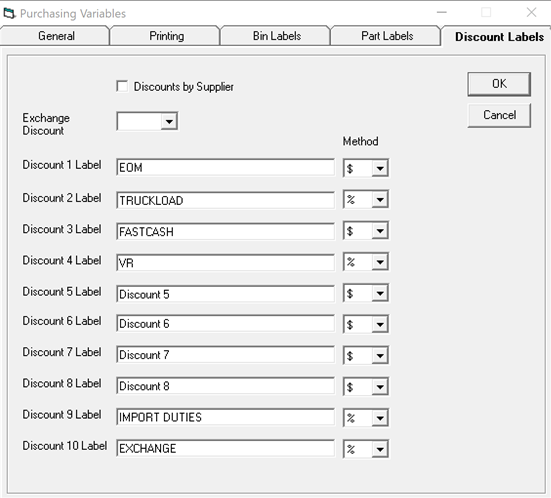

Purchasing Variables

Discounts by Supplier: Discounts can be global, I.E. all suppliers track discount 1 as End of Month, or we define discounts within each supplier. Discounts by Supplier is more geared towards volume rebates and related truckload or negotiated discounts.

Exchange Discount: if you are importing products, what discount level is being used to track the exchange expense? Positive discounts reduce the cost of the serial number and negative discounts add to the cost. Exchange must always be defined as the same discount level so that EPASS can accumulate it properly as part of the purchasing system.

Discount 1 through 10: The discount can be labelled plus you define if this amount is a flat dollar amount of a percentage.

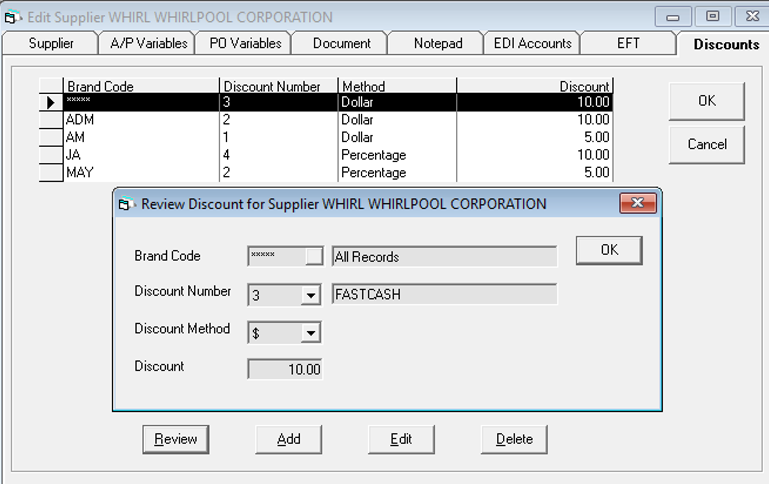

Supplier Maintenance

When using Discounts by Supplier, you can define each discount within each supplier. This is often used for volume rebates or similar negotiated discounts.

In this example Discounts by Supplier are being used.

Whirlpool, being a large corporation, offers a variety of discounts for each line. As you can see, we have multiple discounts set up and some are by dollar and some are by percentage. As a purchase order is being done, these discounts can be modified if needed and, as product is being received, each one of these discounts is being applied to the serial numbers being received.

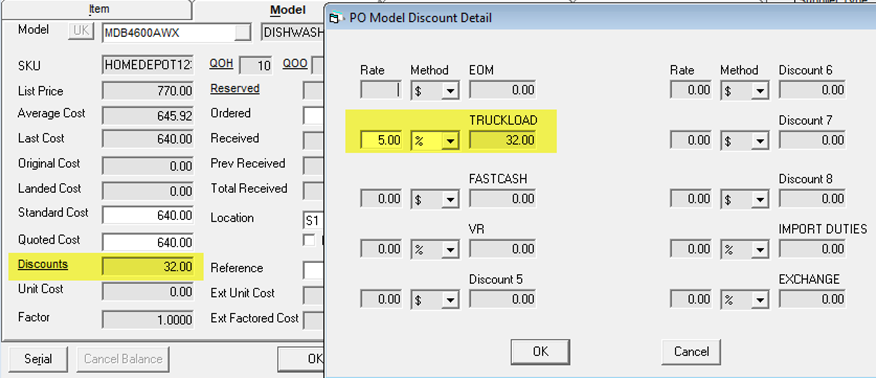

PO Detail - Ordering

As a model is added to the PO, notice the discounts are being populated. The discounts can also be adjusted as needed for each PO if needed. In this example I have a truckload discount set up. If you only occasionally do a truckload, then setup the truckload discount on the supplier as zero so you can fill it in only on those purchase orders where it is relevant.

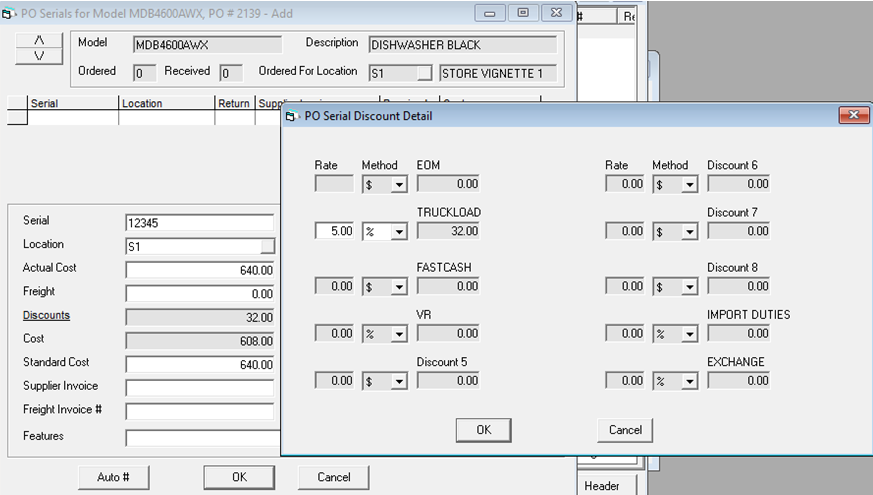

PO Detail - Receiving

When serial numbers are being received, either through manual entry or through barcoding (wireless) or when serial numbers are being costed, the same discount details are being recorded.

EPASS will forever track that this piece came in at $640.00 and had $32.00 in discounts bringing the final cost down to $608.00. Inventory Asset, COGS, Sales Analysis will be at $608.00 giving you a true margin.

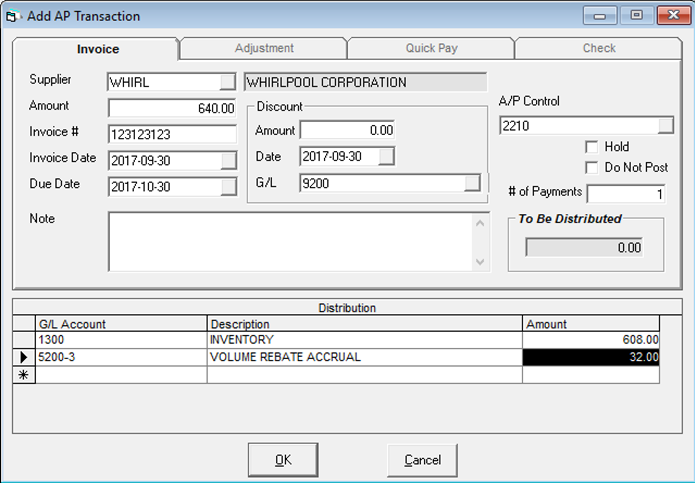

Accounts Payable Invoice

In the purchasing example above using a truckload discount, you would expect the invoice to be $608.00 but, in the new example of a volume rebate or any form of trailing rebate, you still need to pay the full invoice to the supplier and track the rebates expected. In this case, the invoice is $640.00 but, since we have reduced the cost of the serial number based on the expected volume rebate, we want to put $608.00 to Inventory Asset and $32.00 to a volume rebate accrual account.

This way, COGS will be correct and, when we receive the volume rebate at the end of the quarter, we will apply that to an offsetting account so we can always see what we expected in volume rebates and what we received.

Crystal Reports can also be designed to accumulate the volume rebates accrued by brand or by supplier and compare them to what is received.