Updated September 7, 2022

Credit Approval encompasses a wide variety of credit issues for both charge accounts and third party financing. Charge accounts may be at or near their credit limit, some accounts may be questionable and every order must be approved or, in the case of third party financing, somebody has to make sure the credit application has been approved.

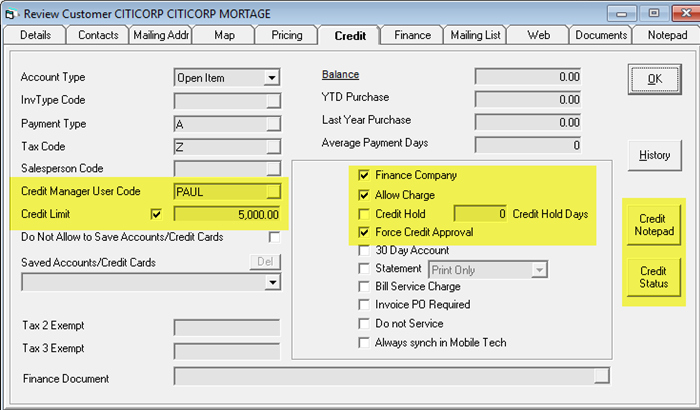

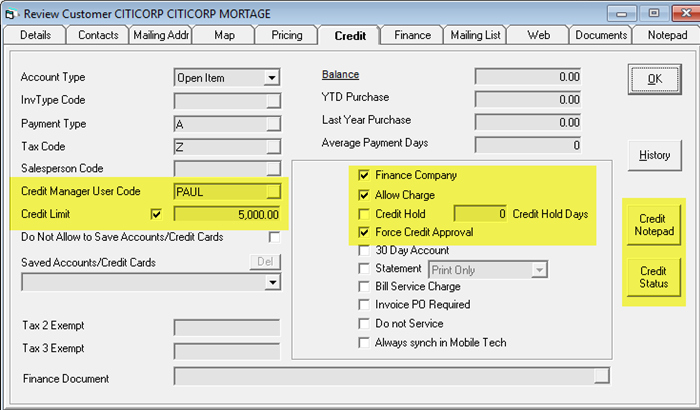

The credit tab is where most of the credit approval options are maintained.

Credit Manager User Code: This is the EPASS user who will be messaged when this customer has any invoices that require credit approval. This could be a builder who has reached their credit limit or is set to Force Credit Approval. This is also important in cases like CitiCorp, so the AR person responsible for making sure credit applications have been processed for customers is notified.

Credit Limit: The credit limit checkbox means the credit limit is enabled and the second field is the amount of the credit limit. Accounts receivable variables controls if the credit limit includes open orders or only finished invoices.

Finance Company: Although this is not directly related to credit approval, by checking the finance company checkbox, when a salesperson is writing an invoice and they check Financed, only those customers selected as a finance company can be selected as the bill to customer on that invoice.

Allow Charge: The allow charge supersedes the credit limit. If you uncheck Allow Charge, the customer cannot charge anymore. Invoicing will stop you from writing a charge invoice for this customer and barcoding will not let you ship anything to this customer if the invoice was a charge.

Credit Hold: Credit hold supersedes the credit limit and allow charge. As soon as a customer is on Credit Hold, nothing can be dispatched or shipped. You cannot scan product out through the barcoding system and you cannot manually attach serial numbers to an invoice.

Force Credit Approval: This option will require that every invoice will require credit approval before it can be dispatched or shipped. This can be used both for builders that are on questionable credit terms or for companies like Citi, or Wells Fargo where they are third party financing that must be approved before the invoice can be dispatched or shipped.

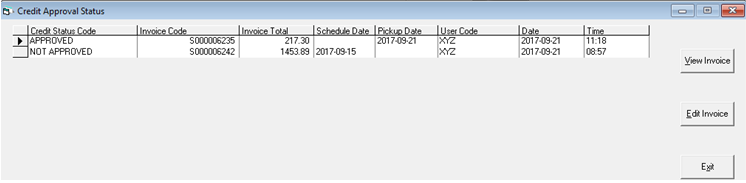

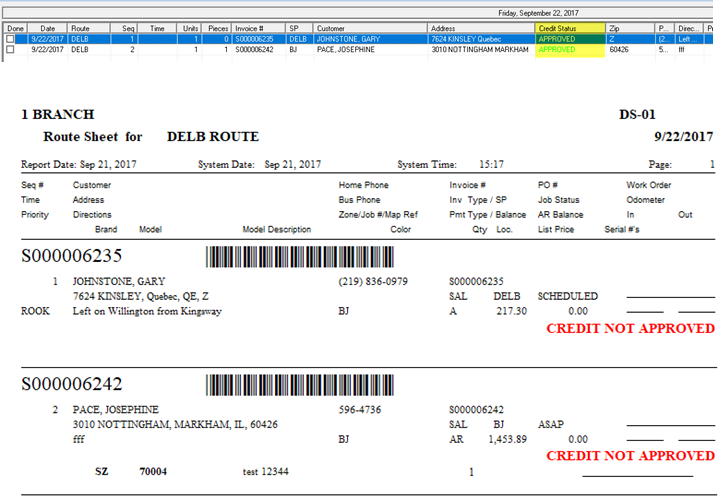

The Credit Status will show you all invoices that are approved or not approved and are still open. Buttons are available to view or edit the invoices to change the credit status.

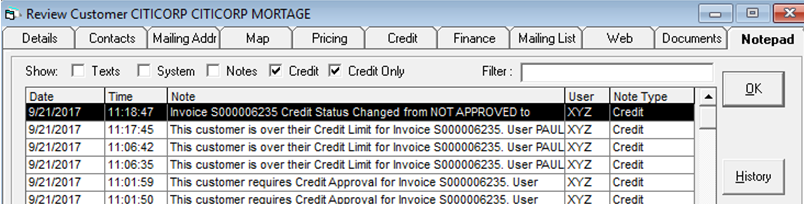

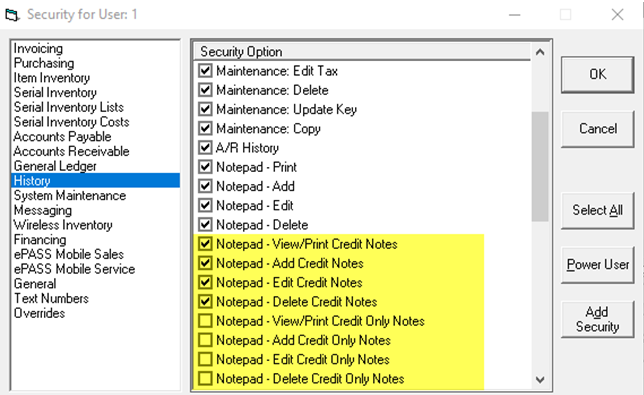

The credit department has their own notepad to separate credit related notes, which might be private and confidential, from the regular customer notes. User security controls who can see which notes. Every time a salesperson attempts to schedule an invoice that requires credit approval, or the credit approval status on an invoice is changed, or anything related changes a note is generated in the credit notepad.

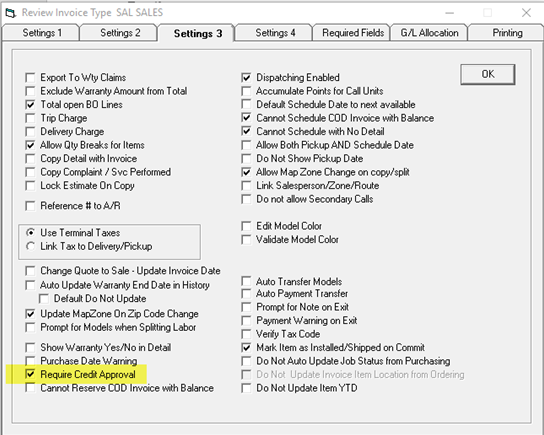

The Invoice Type must have credit approval enabled and the payment type must be a charge or else credit approval will not be triggered.

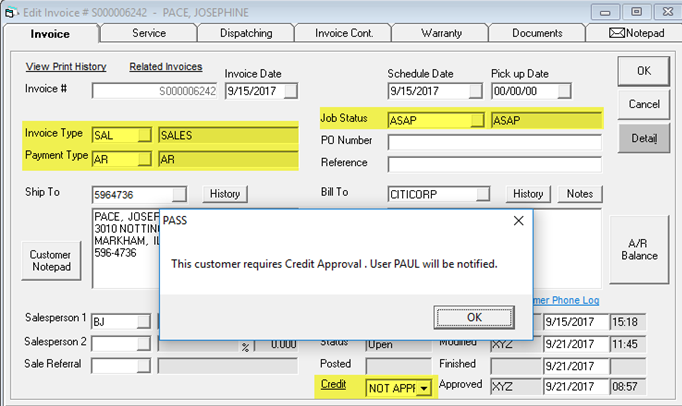

When a salesperson changes the job status to one that is dispatched, the warning message shown above will be displayed and a message event is triggered to notify the credit manager. The job status will be put back to the original value until the credit approval has been granted. This way, you cannot dispatch an invoice that is not credit approved.

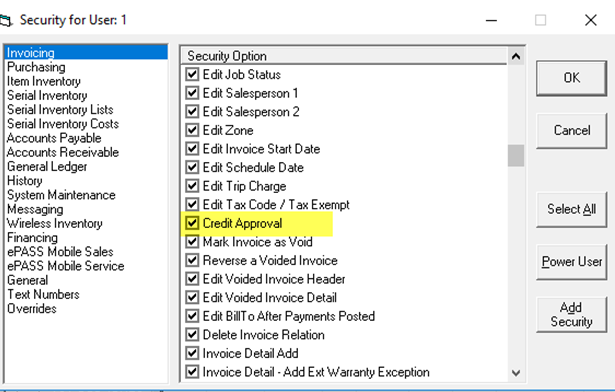

Security controls who can change the credit status and has access to the Credit (credit notepad) hyperlink.

Adding detail to the invoice can also trigger the over credit limit warning and message event.

The routing screen and the Route Sheet both show the credit status. In this case, the invoices were previously approved but the account was put on Credit Hold after the approval. The Route Sheet shows the credit problem and the barcoding will not allow the product to be shipped.

Invoices are not changed from their ‘Approved’ status when a customer goes on Credit Hold because, once the issue with the account is resolved and they are taken off Credit Hold, all the invoices will automatically go back to their original state.

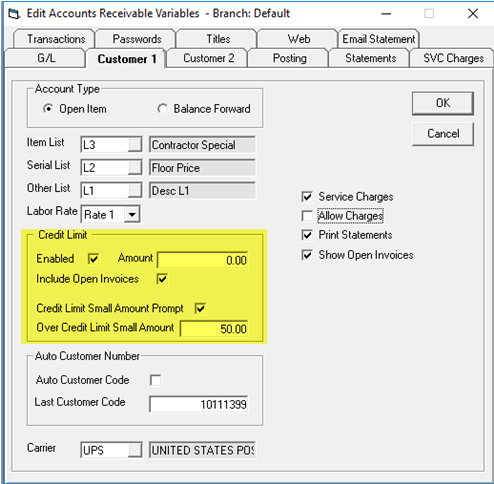

In System Maintenance, we have two tables that are connected to credit approval along with user security.

These are the defaults for new customers.

Include Open Invoices: Does the credit limit only include finished invoices or does it also include all open invoices?

Credit Limit Small Amount Prompt: This would allow a customer to go over their credit limit by a small amount and will have a different security level.

Amount: Used to define how much the customer can go over their limit.

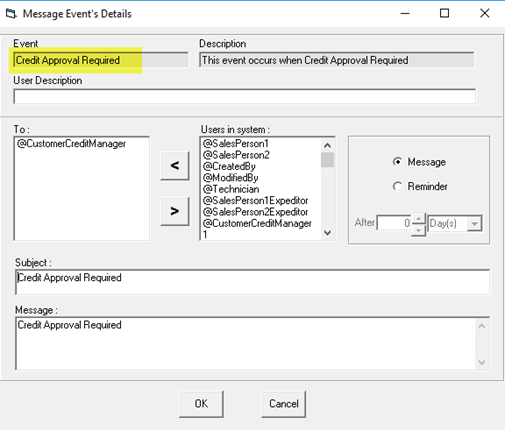

You can configure who receives the credit approval message event.

Require Credit Approval must be enabled on the settings 3 tab.

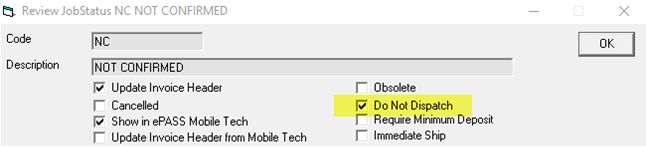

Credit Approval is triggered on job status when Do Not Dispatch is un-checked. Using a job status that has this selected will NOT trigger credit approval.

Invoicing security controls who can change the credit status.

History security controls who can go to the credit tab and control the credit notes in the invoice notepad.

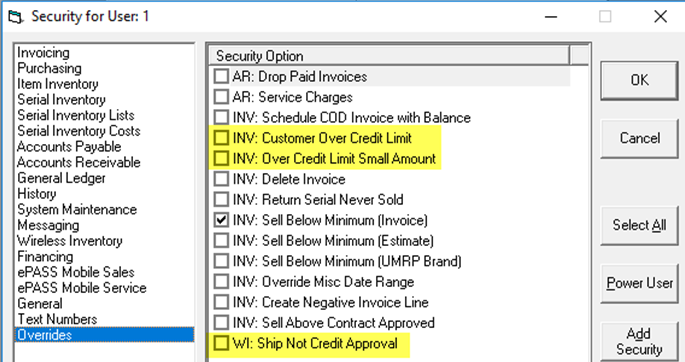

Overrides security controls what you are allowed to override.

Invoicing: Customer Over Credit Limit

Invoicing: Over Credit Limit Small Amount

Wireless Barcoding: Ship Not Credit Approved