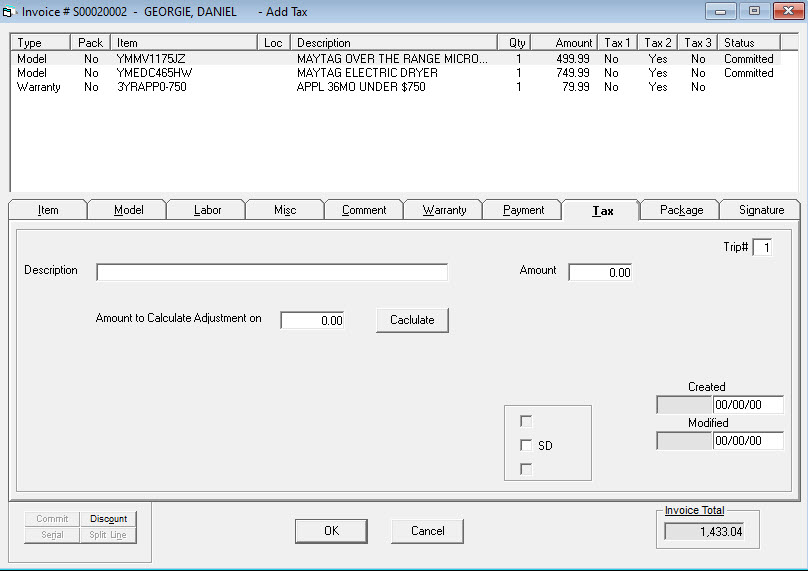

Adding a Tax Adjustment

Tax adjustments have most commonly been used in service companies, when a technician manually calculated taxes and made a mistake. A tax adjustment line lets you increase or decrease the tax amount by a specified amount.

| Description | A description of why you are making the tax adjustment. |

| Amount | The amount of the tax adjustment. |

| Amount to Calculate Adjustment On | If you want to have EPASS calculate the tax on a certain amount, enter the amount here and click the calculate button. That will fill in the amount field for you. |

| Tax (checkboxes) | Choose which tax this adjustment applies to. Depending on how the tax works in your region, you’ll either use one or two of the tax boxes, so just choose the appropriate one. |

| Trip # | This is only applicable for a service invoices. It designates on which trip this comment applies to. |