Writing Financed Invoices

Scenario 1

Customer is approved for the full amount of their purchase or more. For example, customer’s invoice is valued at $4078.56; they apply for financing and get approved for $12,000.00.

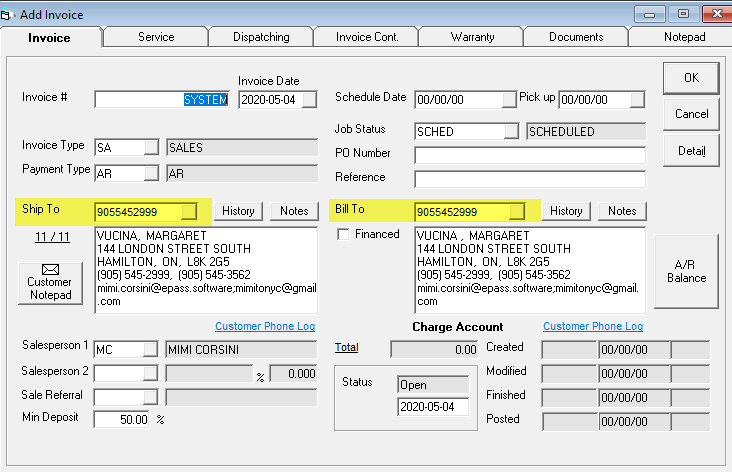

‘Ship to’ and ‘Bill to’ in EPASS should ALWAYS remain the customer account number as the sale itself is between you and the customer (the finance company is only paying for the purchase). By doing this, most EPASS clients find it much easier to track the dollars which were received by the customer and the finance company all within the customer history of which it belongs to.

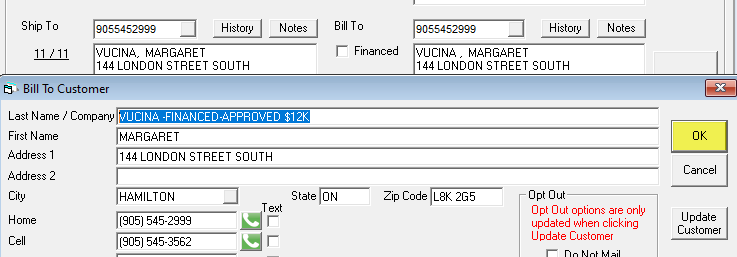

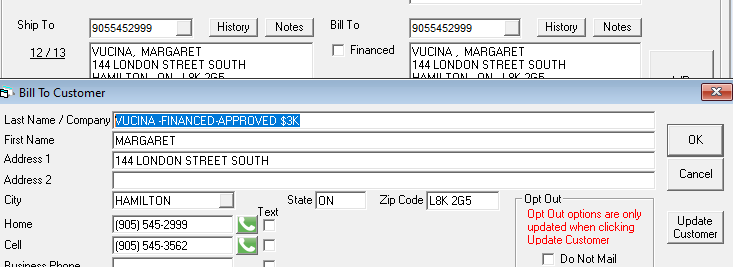

Double click in the Bill to box of the invoice header to update the last name; note something like “FINANCED-APPROVED $12K” and only click OK as you are only making a change to the last name on this one invoice to note it has been approved for financing.

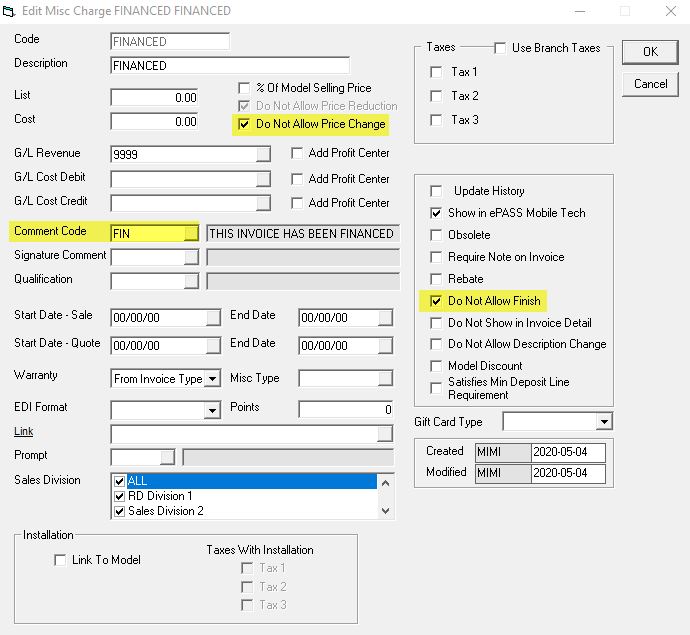

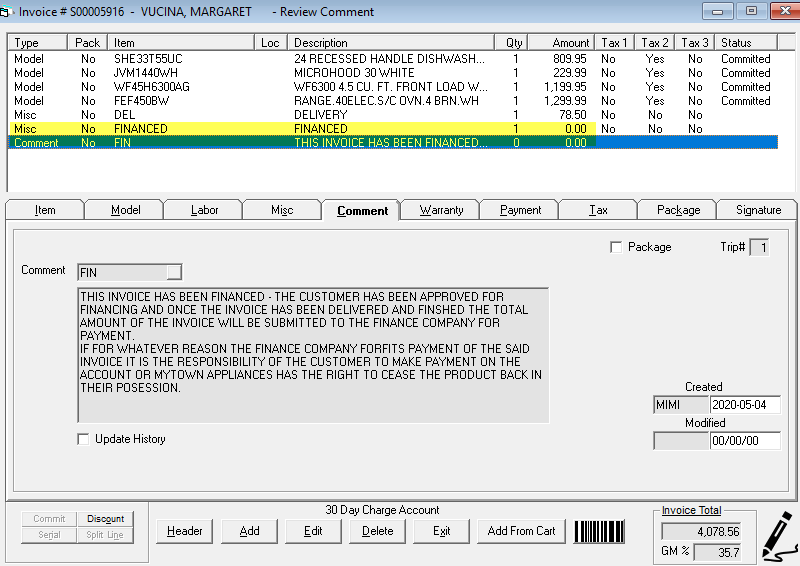

Complete the detail of the invoice selling product etc. as usual, but also add a misc. code line to the invoice which will be marked as “Do Not Allow Price Change” (just so no one adds a price to this line item on the invoice), and “Do Not Allow Finish” (this is a trigger that someone needs to submit to the finance company for payment).

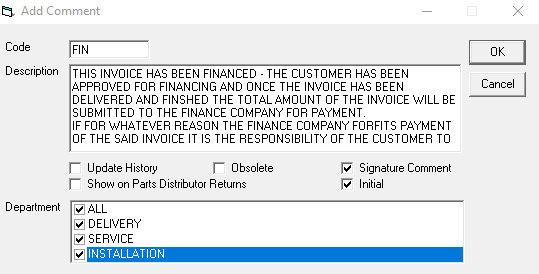

Attached to the misc. code, quite often, is a comment code that will automatically be added to the invoice with the misc. code.

The invoice will not show the balance paid for until the invoice is delivered and finished and payment has been received by the finance company.

The invoice will then ship out or be delivered to the customer as usual but, when the paperwork comes back from delivery, the individual trying to finish the invoice will not be able to finish it with the misc. code FINANCED on it. Again, this ensures you notify the person in the company required to submit this invoice to the finance company for payment.

Once they have notified the person that submits for payment, the finishing person can remove the misc. code from the invoice and proceed with the finishing process.

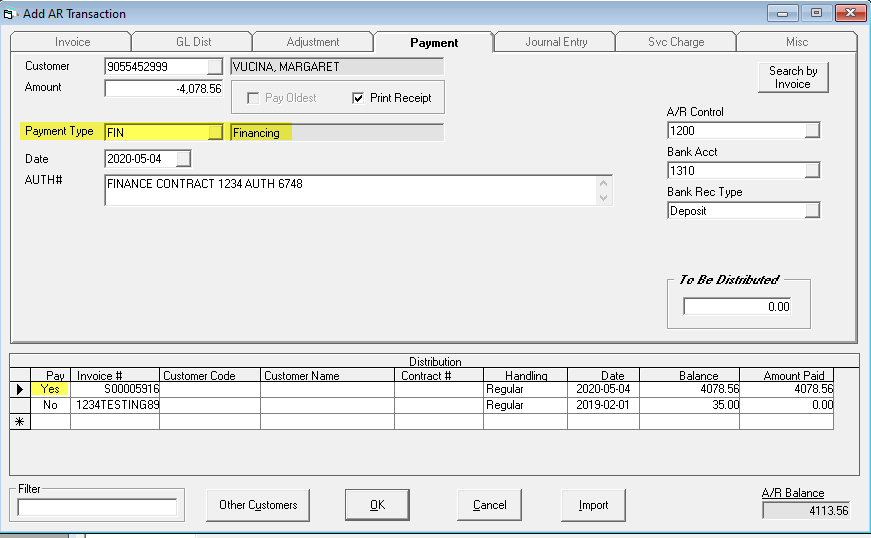

Since the invoice will be finished when the payment arrives from the finance company, it is applied to the customer account in AR.

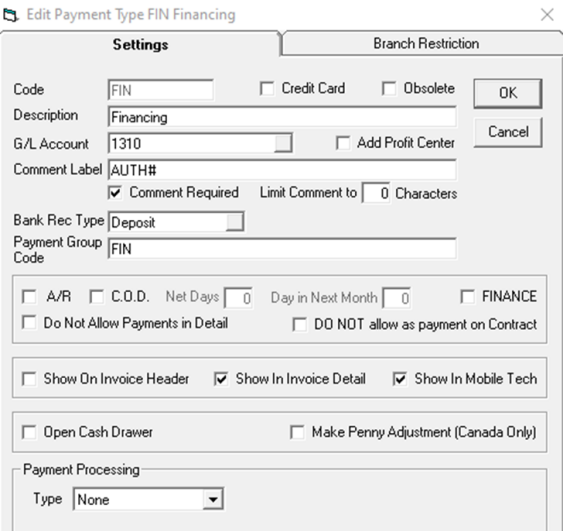

You will have set up a payment type (or several) for each finance company you work with. This is the payment type that is then applied when making the payment to the customer’s AR.

Flow

AR > Transaction processing > Payment > find the Customer > enter the payment amount received from the finance company > Payment type Finance Company > make a comment, if needed > distribute the amount to the applicable Invoice > click OK.

Scenario 2

Customer is approved for a lesser amount then what they have purchased. For example, customer’s invoice is valued at $4078.56, they apply for financing and only get approved for $3000.00.

All the steps from above still apply. The ‘Ship to’ and ‘Bill to’ in EPASS should ALWAYS remain the customer account number as the sale itself is between you and the customer (the finance company is only paying for the purchase); however, you will only make note of the $3000 approval on the invoice header ‘Bill to’ customer account.

Complete the detail of the invoice selling product etc. as usual, but also add a misc. code line to the invoice which will be marked as “Do Not Allow Price Change” (just so no one adds a price to this line item on the invoice), and “Do Not Allow Finish” (this is a trigger that someone needs to submit to the finance company for payment).

Require payment by the customer for the amount that was not covered by the finance company.

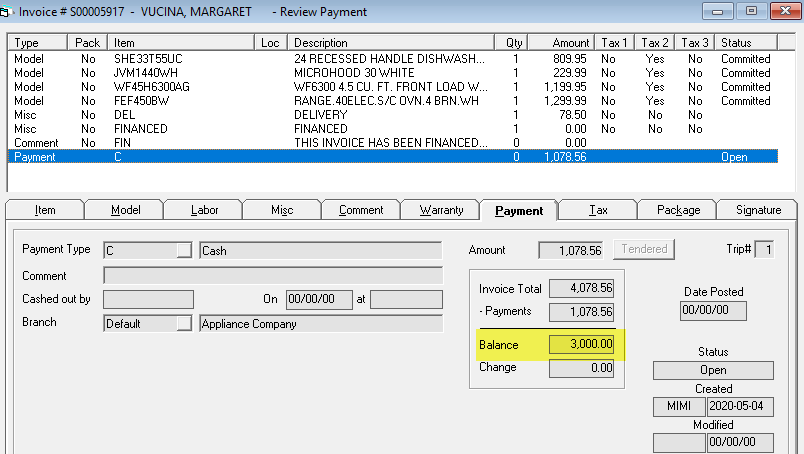

In our example, the customer invoice totals $4078.56 and is only approved for $3000.00. Add the payment from the customer to the invoice for $1078.56 by whichever payment type they use to pay this difference.

By applying the customer payment, it will reflect to the customer the balance owing which will be collected from the finance company once the invoice has been delivered and finished in EPASS.

Continue here by following the steps from Scenario 1 for finishing once delivered, submitting to the finance company for payment, and applying payment in AR to the customer account.

By following the above method with the ship to and bill to being the customer account, it is much easier to troubleshoot if you have a problem tracking the payments as all payments stay with the customer account. Ultimately, the invoice is a contract between you, the appliance company, and the customer not with the finance company.

The finance company will just be a form of payment once the invoice has shipped and payment has been received by the finance company.

Scenario 3

Follow all other above steps in Scenario 1 and Scenario 2, then:

If you follow the “invoice must be paid for in full” procedure in EPASS, then you may want to consider this further step and setup so that you don’t show any payment that you have not yet received (just to be allowed to ship).

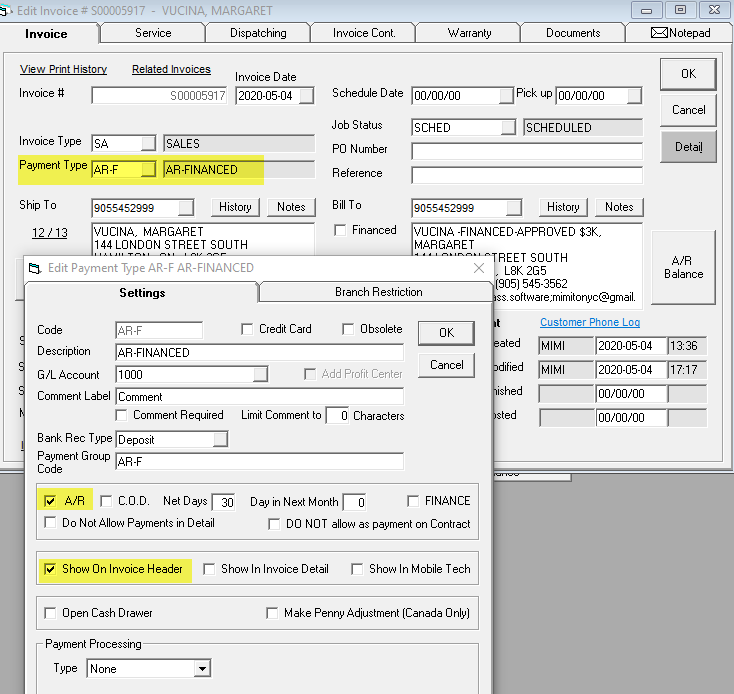

Consider setting up a payment type like ‘AR-F: AR Financed’. Then, only on the invoice header of that one invoice would you select that as the overall invoice payment type to allow for shipping and not skew the actual account balance owing. It would also work in cases where the customer has to pay a portion of the invoice as they would still make their payment, the invoice would deliver out no problem, and then the balance is collected in AR.

If desired, you can still create the AR-Financed payment type for the invoice header only but mark it COD instead of AR; it will identify on the header that this invoice has been finance approved and still doesn’t let you ship with a balance owing.

So that you don’t have to give anyone access to the credit limit or allow to charge in Customer Maintenance, keep all the steps the same as originally documented and, once a day for the following day’s shipments, someone would run the OE-27 for the misc. code ‘Financed’ and submit to the finance company for payment then apply the confirmed finance payment to the invoice so that the next morning they can ship the invoice out. This way you are only applying payments to the invoice the day before they ship and they are actually confirmed submitted to the finance company.