OE-13 MTD Tax Register

The OE-13 Tax Register is your main report for sales tax collected. We will show you how to compare this to the General Ledger to make sure it is in balance and how to also handle GST/HST for our Canadian clients and show you how to make a typical AP entry to pay taxes.

The report has three ‘taxable’ columns, Tax 1, Tax 2 and Tax 3.

Tax 1 is currently not in use and is similar to a VAT where the tax is included in the price of the product and commonly based on the Cost of the product. The last time it was used as a number of years ago in the USA when warranty items were charged tax based on the cost of the item.

Tax 2 is the most common tax used in EPASS for States where one level of tax is charged. This tax rate may change based on the delivery location but the tax rate is one rate for the invoice. Ie 6% or 6.25%.

Tax 2 is also used in Canada for Provinces where they charge PST or HST, they do not separately charge PST and GST.

Tax 3 is used in the USA if you wish to separate State & County taxes as two separate figures/calculations. Ie 1.5% County (Tax 2) and 6% State (Tax 3).

Tax 3 is used in Canada if you charge PST and GST. PST will be Tax 2 and GST will be Tax 3.

Invoices that have a Tax-Exempt number filled in but have a regular Tax Code will not charge that tax rate and will show that dollar amount in the ‘Exempt’ column to the right of Tax 2 or Tax 3.

Most often when a customer is tax exempt clients will setup a tax code ‘EX’ for exempt for those clients so it groups them separately on the OE-13 Tax Register. Some clients find it helpful to setup multiple tax-exempt tax codes to differentiate Resale from Churches and Other tax-exempt organizations.

Below we will explain how to read each report.

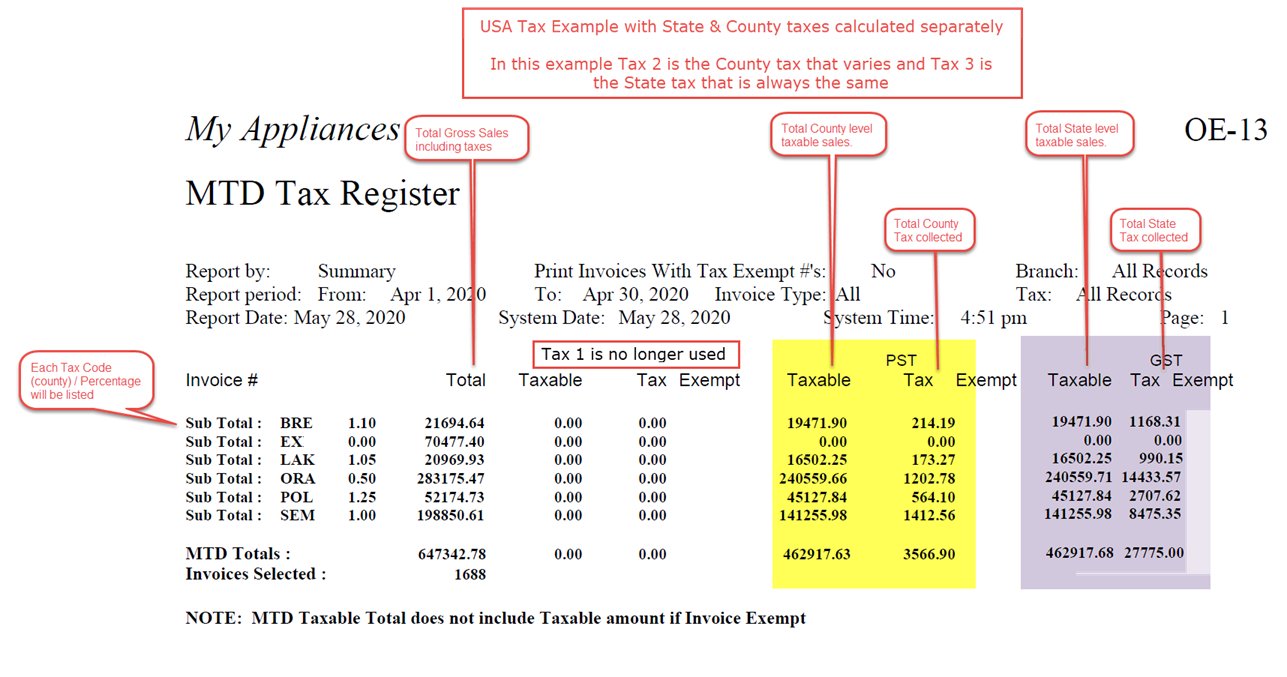

Above is the most common setup for States where you have one tax rate for the whole State or States where the tax rate varies from county to county but you still charge one flat rate. You are not charging 6% State and separately 1.5% County tax.

In this example the company delivers to Massachusetts, New Hampshire and Rhode Island. There is also one Tax Code for ‘EX’ Exempt.

For EX (Exempt) sales there were 73145.42 and no taxes were collected.

For MA at 6.25% the total sales including taxes is 801564.61. The middle column that is labeled ‘PST’ is Tax 2. There was 740927.35 of taxable goods sold. The difference (801564.61 – 740927.35 – 46307.96) 14329.30 is the non taxable product / services such as delivery fees. The sales tax collected was 46307.96.

For NH there was 81764.23 in total sales but the tax rate is zero, so no taxes were charged but since it needs to be reported to the appropriate government agency it is best to make a tax code to separate New Hampshire.

RE - Rhode Island is at 7% and total sales including taxes where 52544.94 with 41510.35 of taxable sales and they collected 2905.71 in tax.

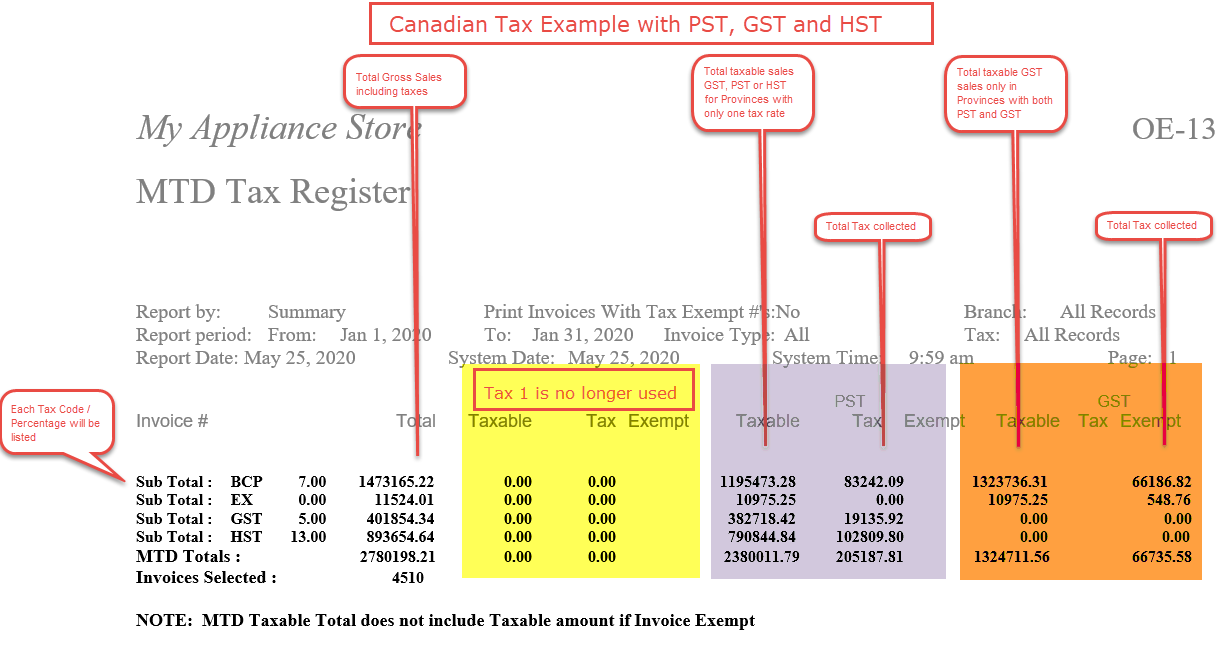

The image above combines various Provinces and the different tax possibilities.

If you were in BC or another province, where both PST and GST are charged you would setup Tax 2 as PST and Tax 3 as GST.

If you were in Alberta where there is no PST, they only have GST, then Tax 2 would be GST.

If you were in Ontario where they have HST then Tax 2 would be HST.

For BCP the total sales including taxes is 1473165.22. The total sales that were taxable at the PST level are 1195473.28 of which 83242.09 was collected in PST. The difference of (1473165.22 – 1195473.28 – 83242.09 – 66186.82) 161263.03 is how much product / services was not PST taxable such as labor. GST (Tax 3) has 1323736.31 of taxable sales of which 66186.82 of GST was collected.

For EX (Exempt) sales there were 11524.01 in total sales and no PST (Tax 2) taxes were collected but PST exempt sales are not generally GST exempt and so there was 10975.25 in GST (Tax 3) taxable sales of which 548.76 in GST was collected.

For the next two lines GST and HST, in both cases these are provinces that are only charging one level of tax.

The GST line is setup to use Tax 2 and so with a total sales including taxes of 401854.13 it has a taxable amount of 382718.42 and a tax collected of 19135.92. For GST there is nothing the typical EPASS client would sell that is GST exempt and so you will notice the sum of 382718.42 + 19135.92 = 401854.13.

The HST line is similar to the GST line and as previously noted when there is only one tax level Tax 2 is the most common choice as it provides the most flexibility.

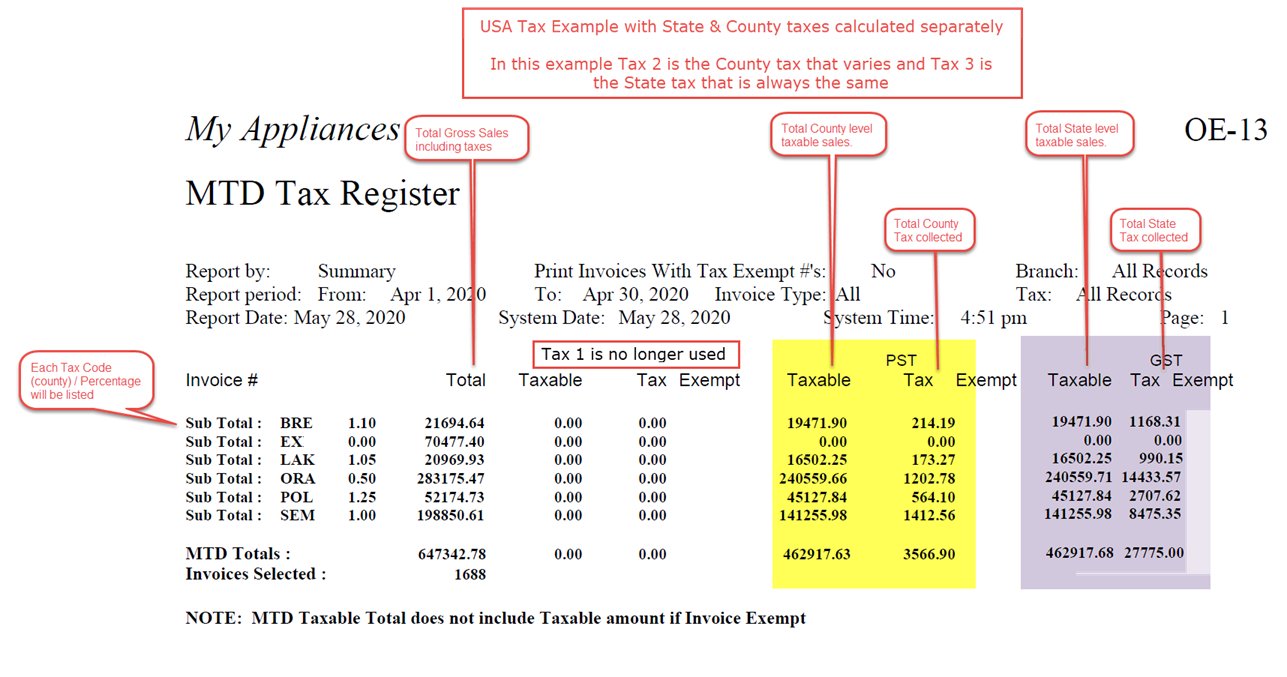

This example is where you need to calculate/remit the State taxes and the County/Local taxes separately. For example in Florida there are maximums on the County taxes yet the State tax has no limits, so in this case you must separate State and County taxes to show the consumer how much tax is being collected at the State level and how much is being charged at the County level.

Each of our Tax Codes and percentages shown relate to a County and the County Tax is Tax 2 since it changes from invoice to invoice and the State tax is Tax 3 because it is consistent.

For Tax Code BRE at 1.1% there was a total of 21694.64 of taxable sales including all taxes collected. The amount taxable at the County level (Tax 2) is 19471.90 of which 214.19 tax was collected. At the State level the taxable sales were 19471.90 and 1168.31 in sales tax was collected. To calculate non taxable sales at the County level (Tax 2) we must subtract all taxes collected and the Taxable sales from the Total. 21694.64 – 19471.90 – 214.19 - 1168.31 = 840.24. To calculate non taxable sales at the State level (Tax 3) we would use the same formula.

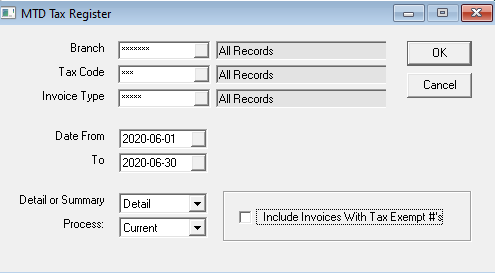

Calculating the Tax in USA:

- Run the OE-13

Calculating the Tax in Canada:

- Run the OE-13

- Run GL Account status for your GST / HST Tax Paid account(s)

- Net difference is what needs to be remitted

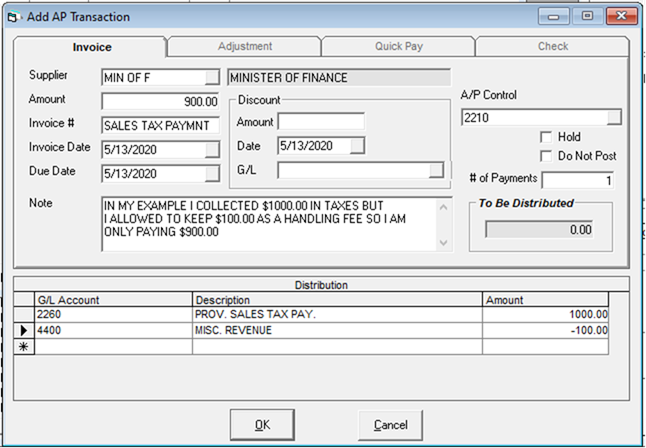

Sample AP Entry for Sales Tax

This entry could be done as an Invoice or a Quick Pay. In this example you are allowed to keep a handling fee that is not remitted to the government.

It is important to make sure the positive/negative sign on the Amounts is correct. Generally, the Amount going to the Sales Tax Collected GL account will be positive.

If your government does not allow you to keep a ‘handling fee’ then the only difference will be the Distribution section will only contain the one line for the GL Account for Sales Tax Collected.

Below is the same entry with GST or HST (Canada only) and we are doing it as a Quick Pay.