Click to view parameter descriptions.

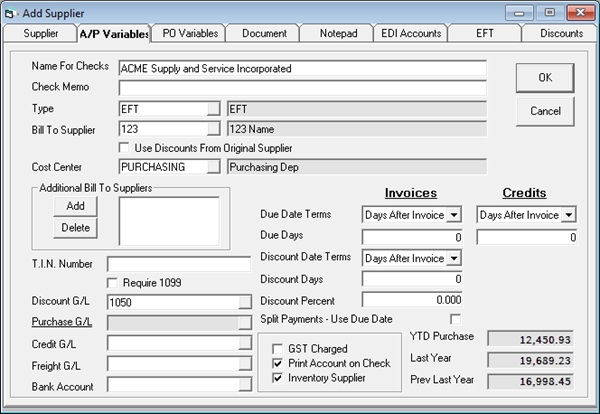

Name For Checks:Enter

the Supplier's full name as it should appear on a check. If this

field is left blank, the Name

field on the Supplier

tab is used instead. Name For Checks:Enter

the Supplier's full name as it should appear on a check. If this

field is left blank, the Name

field on the Supplier

tab is used instead.

Check Memo:Check styles can be customized to

print this check memo field if desired. Check Memo:Check styles can be customized to

print this check memo field if desired.

Type:Populated from Tools > System

Maintenance > Supplier Type. A way to group similar suppliers

based on how you pay them so you can run reports and checks separately

for those suppliers you pay by check vs suppliers paid by credit

card. Type:Populated from Tools > System

Maintenance > Supplier Type. A way to group similar suppliers

based on how you pay them so you can run reports and checks separately

for those suppliers you pay by check vs suppliers paid by credit

card.

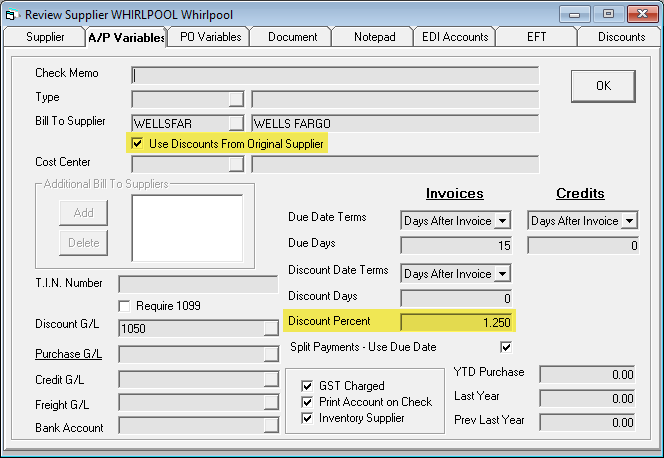

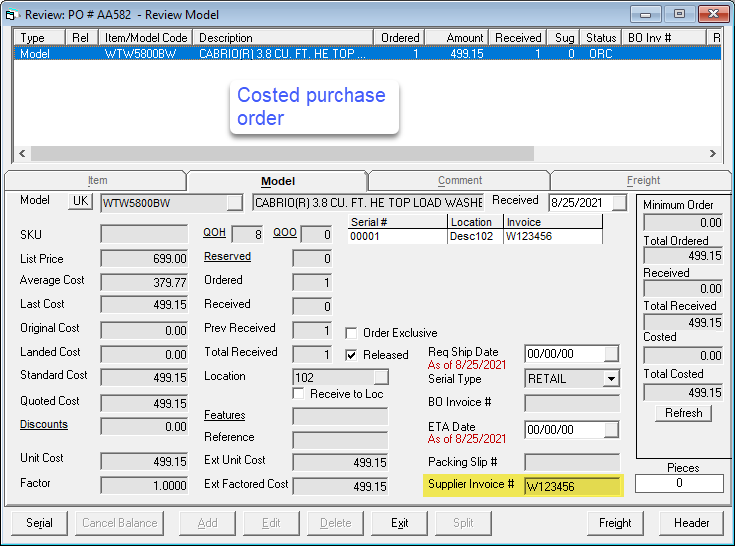

Bill to Supplier and Additional Bill

to Suppliers:Used

for your inventory suppliers where you are financing the purchases.

For example, you are purchasing

Whirlpool product but it is being financed by Wells Fargo you

would put the suppler code for Wells Fargo into the Bill to Supplier

field for Whirlpool. This will let you write the PO for

Whirlpool but, when it comes time to key in the AP invoice, the

supplier code will flip to Wells Fargo. Additional Bill to Suppliers lets

you add additional choices for who the supplier will be set as

when creating the AP invoice. This also includes the supplier

themselves. In the Whirlpool example you may

normally go through Wells Fargo but occasionally you pay Whirlpool

directly; you can add Whirlpool into the list of additional suppliers. Bill to Supplier and Additional Bill

to Suppliers:Used

for your inventory suppliers where you are financing the purchases.

For example, you are purchasing

Whirlpool product but it is being financed by Wells Fargo you

would put the suppler code for Wells Fargo into the Bill to Supplier

field for Whirlpool. This will let you write the PO for

Whirlpool but, when it comes time to key in the AP invoice, the

supplier code will flip to Wells Fargo. Additional Bill to Suppliers lets

you add additional choices for who the supplier will be set as

when creating the AP invoice. This also includes the supplier

themselves. In the Whirlpool example you may

normally go through Wells Fargo but occasionally you pay Whirlpool

directly; you can add Whirlpool into the list of additional suppliers.

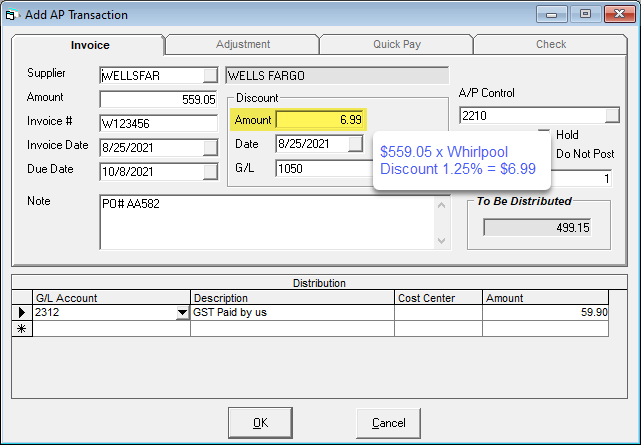

Use Discounts From Original Supplier:To

use the early pay discount percent from the original supplier

instead of the Bill To Supplier on an AP Invoice , select the

checkbox “Use Discounts from original Supplier”. Use Discounts From Original Supplier:To

use the early pay discount percent from the original supplier

instead of the Bill To Supplier on an AP Invoice , select the

checkbox “Use Discounts from original Supplier”.

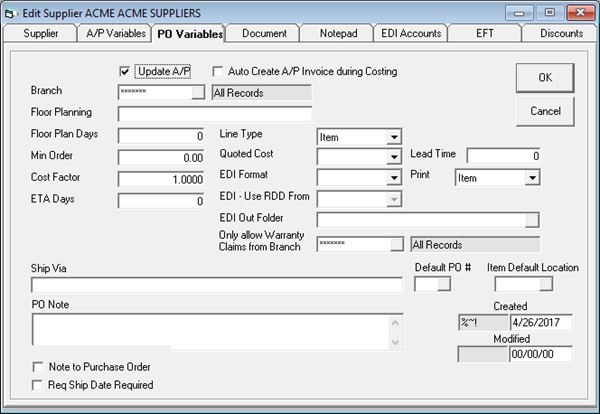

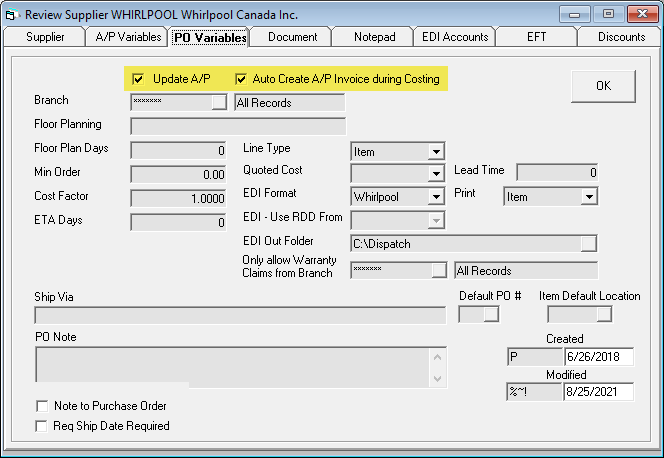

Make sure the “Update A/P” and “Auto Create A/P Invoice during

Costing” checkboxes are selected on the PO Variables tab.

Example (AP Invoice)

Once the purchase order has been costed, the auto AP transaction

generated will calculate the discount based on the original supplier.

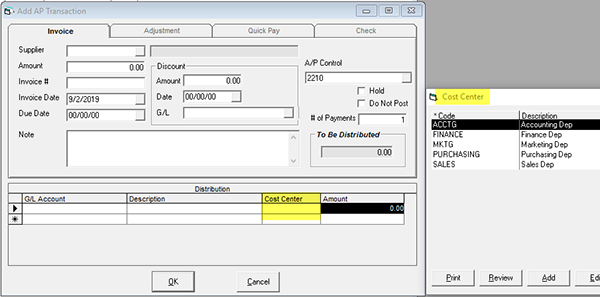

Cost Center:Allows your company to monitor spending

by department. Tools > System Maintenance

> Cost Center. If it’s filled in and you create

an invoice for this supplier, it will populate the cost center

field with this value by default. Cost Center:Allows your company to monitor spending

by department. Tools > System Maintenance

> Cost Center. If it’s filled in and you create

an invoice for this supplier, it will populate the cost center

field with this value by default.

T.I.N. Number and Require 1099:Fill in the supplier’s Tax Identification

Number here. T.I.N. Number and Require 1099:Fill in the supplier’s Tax Identification

Number here.

Require

1099: There is a Crystal report

in Help > Online Documents which will list all invoices

and adjustments from Supplier History for suppliers with

the Require 1099 checkbox checked.

Discount G/L:If your supplier provides early

payment discounts, this is the GL account you want those accumulated

into. This can be left empty if this supplier

uses the same discounts GL account as defined in Tools >

System Maintenance > Variables > Accounts Payable > General

tab. Do not use an inventory asset GL;

we do not want to reduce our inventory because we pay our invoices

early. We want to accumulate those funds

to reduce our COGS or expenses. Discount G/L:If your supplier provides early

payment discounts, this is the GL account you want those accumulated

into. This can be left empty if this supplier

uses the same discounts GL account as defined in Tools >

System Maintenance > Variables > Accounts Payable > General

tab. Do not use an inventory asset GL;

we do not want to reduce our inventory because we pay our invoices

early. We want to accumulate those funds

to reduce our COGS or expenses.

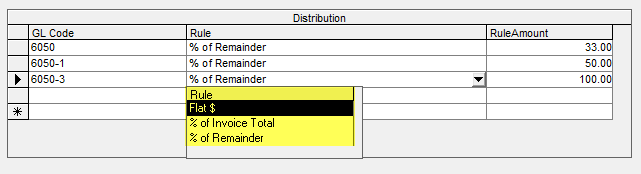

Purchase G/L:Invoices are not always straightforward;

there are commonly multiple GL accounts involved with multiple

distributions. Purchase G/L:Invoices are not always straightforward;

there are commonly multiple GL accounts involved with multiple

distributions.

When you click on the Purchase

hyperlink, the screen below opens up and you can start defining

all the allocations. This distribution does not

affect the GST calculations. GST calculations are always done

in advance on the invoice total.

Distribution

Your options are:

- Flat

$: a fixed dollar amount will

be applied to the GL account.

- %

of Invoice Total: you can allocate 10% to go

to a specific GL account.

- %

of Remainder: you might allocate ½ of the

remaining balance to a GL account.

In the example above, notice

one line that has 33.33% of remainder going to 6050 followed by

50% of the remainder going to 6050-1 and 100% of the remainder

going to 6050-3. These three lines essentially divide

the remaining amount in three.

The first line takes 1/3 of

the remainder. Now we have 2/3 left to allocate,

that is why the second line takes 50% of the remainder. The last line takes 100% of

the remainder because we do not want to leave any funds unallocated.

Credit G/L:This is the GL account credit invoices

will go to. In the parts business this

is important to separate since, with most credits regarding a

warranty claim, we want to affect COGS not inventory asset. Credit G/L:This is the GL account credit invoices

will go to. In the parts business this

is important to separate since, with most credits regarding a

warranty claim, we want to affect COGS not inventory asset.

Bank Account:The bank account can be left empty

for the majority of your suppliers and it will use the default

bank account in Tools > System Maintenance > Variables

> Accounts Payable > General tab but, in cases where

you want a supplier to use a specific bank account, fill it in.

I.E. The payroll company may get paid

from a payroll account or, for companies like R&D that deal

in multiple currencies, you want your Canadian and US suppliers

to be paid from the correct account. This is connected to the check

run as the check run separates batches by the bank account. I.E. It will not pay a supplier

that uses the payroll bank account when running checks from the

general bank account. Bank Account:The bank account can be left empty

for the majority of your suppliers and it will use the default

bank account in Tools > System Maintenance > Variables

> Accounts Payable > General tab but, in cases where

you want a supplier to use a specific bank account, fill it in.

I.E. The payroll company may get paid

from a payroll account or, for companies like R&D that deal

in multiple currencies, you want your Canadian and US suppliers

to be paid from the correct account. This is connected to the check

run as the check run separates batches by the bank account. I.E. It will not pay a supplier

that uses the payroll bank account when running checks from the

general bank account.

Due Date Terms Invoices and Credits/Due

Days:These

fields control how the due date is defaulted during invoice entry

in Accounts Payable > Transaction Processing. Due Date Terms Invoices and Credits/Due

Days:These

fields control how the due date is defaulted during invoice entry

in Accounts Payable > Transaction Processing.

Days

After Invoice: Sets the due date of the invoice

as X number of days after the invoice date where X is the value

in the Due Days field. For example, if the invoice date

was Jan. 2nd and due days was 30, the invoice due date

would be set as Feb. 1st.

Day

in Next Month: Sets the due date as the value

in Due Days for the next month. If the invoice date was Jan. 2nd

and due days is 21, it would set the invoice due date as Feb.

21st.

Day

in Two Months: Sets the due date as the value

in Due Days two months from now. If the invoice date was Jan. 2nd

and due days is 21, it would set the invoice due date as Mar.

21st.

Split

Payments - Use Due Date:

This allows you to split the payments equally and will use

the same date for each future payment. If the invoice due

date is Mar. 21st, and it's split into 3 payments, the future

payments will be due on March 21, April 21, and May 21.

Discount Date Terms/Discount Days:If the supplier offers an early

pay discount, these fields can be filled out to populate the early

pay discount when the invoice is created. You have two selection options for

Discount Date terms: Discount Date Terms/Discount Days:If the supplier offers an early

pay discount, these fields can be filled out to populate the early

pay discount when the invoice is created. You have two selection options for

Discount Date terms:

Days

After Invoice: this will set the discount

expiration date X days after the invoice date where X is the Discount

days field. For example, if the invoice date

was Jan. 2nd and due days was 10 the discount would

expire on Jan. 12th.

Day

in Next Month: Sets the discount expiration

date as the value in due days in the next month. If Discount Days was 5 it would

set the discount to expire on the 5th of the month

after the invoice date.

Discount Percent:This value is used to calculate

the early payment discount amount. Discount Percent:This value is used to calculate

the early payment discount amount.

GST Charged (Canada Only):This controls if the supplier charges

you GST or HST. EPASS will automatically do this

calculation for you based on the amount of the invoice. For example, if the invoice was

for $100 and in AP variables GST is set at 5% it would

automatically write a distribution line for $4.76 to the GST paid

GL account. GST Charged (Canada Only):This controls if the supplier charges

you GST or HST. EPASS will automatically do this

calculation for you based on the amount of the invoice. For example, if the invoice was

for $100 and in AP variables GST is set at 5% it would

automatically write a distribution line for $4.76 to the GST paid

GL account.

Print Account on Check:If selected, this option will print

the value in the Account

# field onto the check.

Note not all check layouts support

this option. Print Account on Check:If selected, this option will print

the value in the Account

# field onto the check.

Note not all check layouts support

this option.

Inventory Supplier:This option controls if you are

able to create a PO for this supplier or define this supplier

on items or models. Inventory Supplier:This option controls if you are

able to create a PO for this supplier or define this supplier

on items or models.

YTD Purchase/Last Year/Prev Last Year:YTD purchase shows the total amount

of business you have done with this supplier in this calendar

year. Last year is the amount done in

the previous calendar year and Prev Last Year is the year before

that (2 years ago). You need to run Accounts

Payable > Utilities > Year End Roll each calendar year

end for these numbers to be accurate. YTD Purchase/Last Year/Prev Last Year:YTD purchase shows the total amount

of business you have done with this supplier in this calendar

year. Last year is the amount done in

the previous calendar year and Prev Last Year is the year before

that (2 years ago). You need to run Accounts

Payable > Utilities > Year End Roll each calendar year

end for these numbers to be accurate.

|