Washington State Tax Utilities

As you may be aware, on July 1st 2008 Washington state switched to taxes based on where the product is being delivered to vs where it was sold. In connection with this tax change, Washington state is also providing a tax region/location verification service to their businesses.

Web Site: http://dor.wa.gov/Content/FindTaxesAndRates/RetailSalesTax/DestinationBased/Conversion.aspx

We have designed two utilities to integrate to this new service being provided by the state. The first utility will export your customer file in the layout specified and the second will re-import the data after the state has processed your file and made the necessary corrections. The re-import utility will make corrections to your customer file where the tax code was wrong plus notify you if the customer has open invoices. You will also be notified of errors where the state could not verify the address and or tax code.

N.B. R&D is not familiar with the government web site and cannot provide advice on how to use their services.

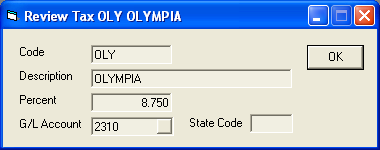

1. Setup the Tax Table to match the State codes.

Tools > System Maintenance > Tables > Tax

You need to edit each tax code and fill in the State code to match the four digit code used by the state of Washington. This is required for the utilities to operate.

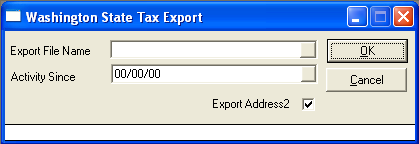

2. Export the Customer File

Customer > Utilities > Washington State Customer Export

Export File Name: This is the file the system will create. You must have sufficient rights to write to the destination file and should name the file so it is easy to find.

Activity Since: When left as zero, all customers will be exported. If you only want to process customers that have done business with you in the last couple years you can fill in a date.

Export Address2: It is optional to export Address 2. Most people use Address2 as either a PO Box, or an Apartment Number, in which case you may not want it exported. The state will use Address2 as part of address validation and that can cause problems in the above examples.

This utility will export your customer database into a tab delimited file format as required by the state. You will need to upload the file to the state for processing. See the government website for details on how and where to upload the file. A progress bar will appear on the screen as the file is generated.

Note: We have found that there is basic validation being done on the data file during the upload process. The state will only report 20 errors and then stop processing, so you need to correct those errors and start all over again at step 2. You must continue this process until the upload is complete, which means there are zero errors. At that point, you will fill in your email address and they will email the 'corrected' file back to you.

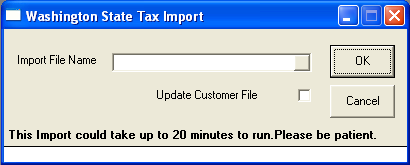

3. Import the Updated Customer File

Customer > Utilities > Washington State Customer Import

Import File Name: This is the file the state sent back to you.

Update Customer File: Do you want the customer file in EPASS updated with the tax code corrections. If this is unchecked, the file will still be processed and the errors report printed, but NO CUSTOMER records will be updated.

This utility will print a report of all customers that are going to be changed and any error messages from the state. The state does not correct addresses, it only provides tax zone and location corrections. It is important for step 1 to be completed or this update procedure will not be able to run properly.

Only when Update Customer File is checked will your customer file be modified.