Avalara AvaTax Configuration Guide

Avalara AvaTax is a cloud-based solution that automates transaction tax calculations and the tax filing process. Avalara provides real-time tax calculation using tax content from more than 12,000 US taxing jurisdictions and over 200 countries, ensuring your transaction tax is calculated based on the most current tax rules.

For more information and to get started with Avalara AvaTax, visit Avalara.com

Once you've completed the sign-up process with Avalara, follow the steps in the guide to complete the integration with EPASS Enterprise.

These steps can only be completed by an EPASS User with administrator-level security options.

Connect AvaTax to EPASS

-

In EPASS, go to Tools > System Maintenance. Click the Variables tab.

-

Select Invoicing, and then click Open.

-

Click the EDI tab.

-

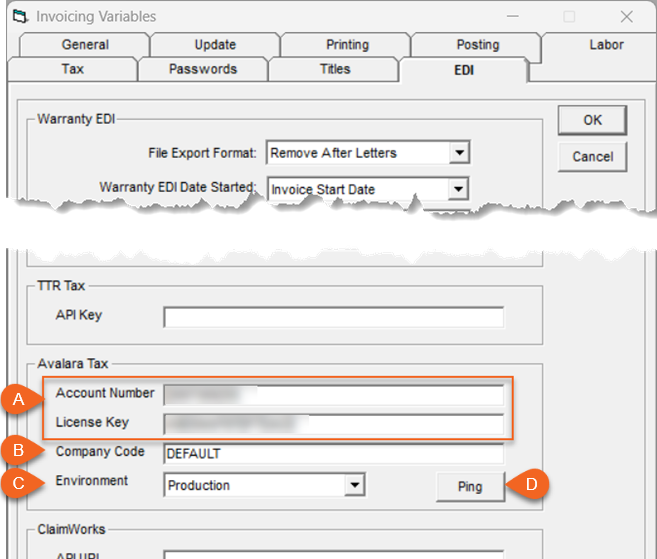

In the Avalara Tax area, do the following:

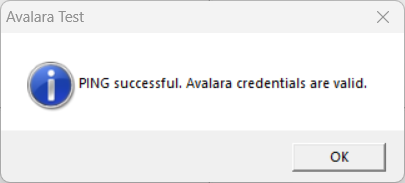

A Enter your Avalara Account Number and License Key (you can get these by logging into your Avalara account.) B In the Company Code field, enter DEFAULT.C In the Environment dropdown, select Production. D Click the Ping button to test the connection.

-

Click OK to close the Invoicing Variables window